Closed Sales of Single-Family Homes in Greater Hartford Rise 8 Percent

Published Thursday, December 12, 2024

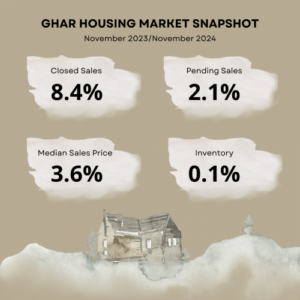

(Hartford, Conn., December 12, 2024) – According to the Greater Hartford Association of REALTORS® (GHAR), closed sales single-family homes in Greater Hartford increased 8.4 percent (from 383 to 415), when compared to November of last year. Pending sales increased 2.1 percent (from 387 to 395) and the median sales price rose 3.6 percent ($364,000 to $377,000). New listings declined 8.2 percent (from 401 to 368) and inventory increased 0.1 percent (from 686 to 687) over the same time frame. The average days on market until sale decreased 17.4 percent (from 23 to 19 days).

In year-to-date statistics, when compared to November of last year, closed sales increased 0.5 percent (from 4387 to 4408) and pending sales increased 1.1 percent (from 4473 to 4522). New listings increased 4.9 percent (from 5139 to 5390) and the median sales price rose 10.0 percent (from $360,000 to $396,075). The days on market decreased 13.0 percent (from 23 to 20 days) from the beginning of the year, when compared to year-to-date last year.

Condominium closed sales in Greater Hartford increased 8.7 percent (from 115 to125) and the median sales price rose 20.9 percent (from $229,000 to $276,750) when compared to November of 2023 over November 2024. Inventory increased 15.1 percent (from 159 to 183) and pending sales increased 18.6 percent (from 113 to 134). New listings decreased 14.2 percent (from 127 to 109) and days on market decreased 26.3 percent (from 19 to 14) during this same month last year.

“It’s been months since we’ve seen an increase in sales activity, which might be due to a slight increase in inventory,” said GHAR CEO, Holly Callanan. “Our market still has challenges so involving a knowledgeable Realtor early in the process is key,” she said.

In the national outlook, Lawrence Yun, National Association of REALTORS® chief economist stated: “The worst of the downturn in home sales could be over, with increasing inventory leading to more transactions. Additional job gains and continued economic growth appear assured, resulting in growing housing demand. However, for most first-time homebuyers, mortgage financing is critically important. While mortgage rates remain elevated, they are expected to stabilize.”